Latest Updates

January 15th, 2021

Update to the All Sports Policy can be found below

il_all_sports_guidance_-_january_15_2021_update.pdf

Update to the T1 and T2 Resurgence Mitigations

Update to the COVID-19 Vaccine Administration Plan

Update to the All Sports Policy can be found below

il_all_sports_guidance_-_january_15_2021_update.pdf

Update to the T1 and T2 Resurgence Mitigations

Update to the COVID-19 Vaccine Administration Plan

December 22nd, 2020

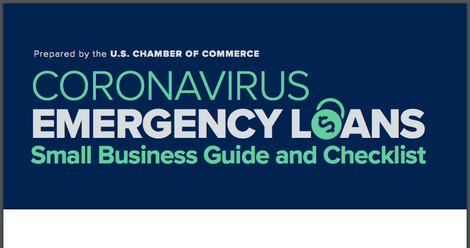

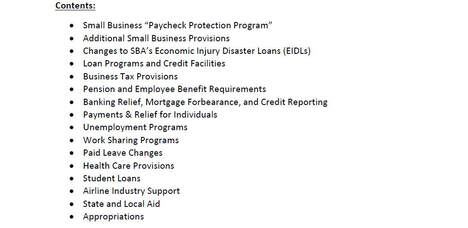

Guide to Small Business COVID-19 Emergency Loans the U.S. Chamber has created a new Guide to Small Business COVID-19 Emergency Loans to provide you with the latest information and answers to FAQs about the changes that have been made to the Paycheck Protection Program (PPP) and the Economic Injury Disaster Loans (EIDL) Program as part of the end-of-year pandemic relief package Congress has passed.

June 26th, 2020

Phase 4 has begun starting June 29th, 2020. Guidelines have been updated with additional information on each industry. Click here to view the overview PDF Click here to view the video outlining the update on Phase 4

June 25th, 2020

Applications Live for $85 Million in New Grants to Help Businesses and Communities. A $25 million economic recovery program to support Illinois businesses that have sustained property damage as a result of civil unrest during protest and demonstrations on or after May 25th, 2020. Click here for more information

June 1st, 2020

Illinois Office of Commerce & Economic Opportunity (IL DCEO) has provided Phase 3 Guidelines. Read the plan here

May 20th, 2020

A link to the U. S. Chamber Reopening Business Digital Resource Center is below. There is an interactive page that shows State by State business reopening guidance. https://www.uschamber.com/reopening-business

May 20th, 2020

Click the image to download the PDF Guide. The Treasury Department and Small Business Administration recently released the application form and instructions for loan forgiveness. The forgiveness forms, instructions, and worksheets can be downloaded here.

May 5th, 2020

On Tuesday, Gov. J.B. Pritzker presented a policy for reopening Illinois, this five-phased plan will reopen the state, guided by health metrics and with distinct business, education, and recreation activities characterizing each phase. This is an initial framework that will likely be updated as research and science develop and as the potential for treatments or vaccines is realized. Click the image to download the full document. Click here to download the one page outline.

April 17th, 2020

To extend a helping hand to small businesses suffering from the impacts of the coronavirus pandemic, the U.S. Chamber of Commerce Foundation – in partnership with Vistaprint and a coalition of supporting companies, foundations, and philanthropic donors – is working to provide financial relief through the Save Small Business Fund. The Save Small Business Fund is a grantmaking initiative to offer $5,000 grants that provide short-term relief for employers across the United States and its territories. Visit www.savesmallbusiness.com for more information and to apply. APPLICATION GOES LIVE - April 20 at 2PM Central Time.

April 8th, 2020

April 8th, 2020

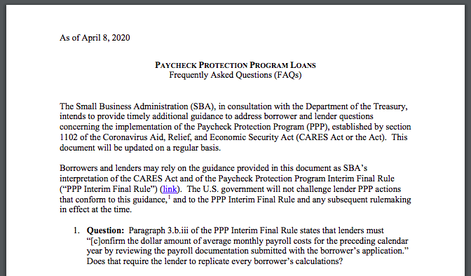

FAQ sheet about the Paycheck Protection Program by the Dept. of the Treasury.

(Updated) April 2, 2020

Congress has approved $350 billion in emergency loans for small businesses to help them keep workers employed. In fact, if small businesses maintain or later restore their payrolls, they may not have to repay some — or possibly any — of the loan. Here’s a guide and checklist from the U.S. Chamber of Commercecoronavirus_small_business_loan_guide.pdf to help your small business through the process.

March 26, 2020

Summary of Bipartisan Agreement on “CARES” Act. Click the image to download the Summary of the CARES act from US Chamber. The U.S. Chamber of Commerce will revise this document as it continues to review the bill.

March 25, 2020

The full details have yet to be released. But over the last 24 hours, the elements of the proposal have come into sharper focus, with $250 billion set aside for direct payments to individuals and families, $350 billion in small business loans, $250 billion in unemployment insurance benefits and $500 billion in loans for distressed companies. Click for more.

March 23, 2020

Elk Grove Village Mayor Craig Johnson on Monday signed a proclamation enacting a $2.8 million coronavirus relief package to aid residents and businesses. Courtesy of Elk Grove Village

Gov. Pritzker’s Coronavirus (COVID-19) Press Conference

Monday, March 23, 2020 Springfield, Ill. – Governor JB Pritzker addresses the media concerning the coronavirus disease (COVID-19). |

SBA to Provide Economic Injury Disaster Loans

SBA to provide economic injury disaster loans for COVID-19 related economic disruptions. Click the image to download the slide show and to learn more.

This is an impact investment loan program under which the State Treasurer would make up to $250 million in deposits available to financial institutions throughout the state, at near-zero rates, to assist Illinois small businesses and non-profits negatively affected by the COVID-19 pandemic. The purpose of this program is to provide vital economic support to small businesses and non-profits to help overcome the loss of revenue they are experiencing. Through this program, the Treasurer's Office would partner with approved financial institutions to provide loans -- either lower rate loans, or loans to a business or non-profit that would not otherwise qualify -- to Illinois small businesses impacted by the COVID-19 pandemic.

· State funds would be deposited with qualified financial institutions for a 1-year term at a near-zero deposit rate of 0.01%

· Deposited funds would facilitate affordable loans (not to exceed 4.75%) to small businesses and non-profits that could be used to provide bridge funding, pay fixed debts, payroll, accounts payable and other bills

· Deposits could be drawn in $1 million or $5 million increments, up to a maximum of $25 million per financial institution

· Eligible Illinois businesses or non-profits must (1) have been shut down or limited due to COVID-19; (2) have less than $1 million in liquid assets or $8 million average annual receipts (per SBA standards); and (3) be headquartered in the State of Illinois or agree to use the funds in Illinois

· Deposits would be renewable as determined by the Treasurer’s Office

· Financial institutions would be required to provide reports to the Treasurer's Office regarding the usage of program funds, including the number and types of loans provided to small businesses and non-profits and the economic impact of such loans

For background, here is a link to the Treasurer's website that explains this program in greater detail: bit.ly/SmallBizRelief.

· State funds would be deposited with qualified financial institutions for a 1-year term at a near-zero deposit rate of 0.01%

· Deposited funds would facilitate affordable loans (not to exceed 4.75%) to small businesses and non-profits that could be used to provide bridge funding, pay fixed debts, payroll, accounts payable and other bills

· Deposits could be drawn in $1 million or $5 million increments, up to a maximum of $25 million per financial institution

· Eligible Illinois businesses or non-profits must (1) have been shut down or limited due to COVID-19; (2) have less than $1 million in liquid assets or $8 million average annual receipts (per SBA standards); and (3) be headquartered in the State of Illinois or agree to use the funds in Illinois

· Deposits would be renewable as determined by the Treasurer’s Office

· Financial institutions would be required to provide reports to the Treasurer's Office regarding the usage of program funds, including the number and types of loans provided to small businesses and non-profits and the economic impact of such loans

For background, here is a link to the Treasurer's website that explains this program in greater detail: bit.ly/SmallBizRelief.

Our Top Priority is the Health of our Community and Businesses

The GOA continues to be a resource for business as we face the threat of the Coronavirus. We have put together this page dedicated to help in any way we can. This page will be updated as resources become available.

Our staff remains operational during this time working to provide short- and long-term business solutions and plans in response to COVID-19.

We encourage you to connect by email with our staff to preserve the continuity of engagement and attainment of your goals.

Please call us at 630.773.2944 or email at [email protected]

Also, we are updating social media with every update we are receiving, please like our page if you haven't done so already to get these updates https://www.facebook.com/GOARegional/

We have also created groups on Facebook dedicated to local businesses at

The GOA Regional Business Association - Shop Local Group

The GOA-Elk Grove Village Chamber of Commerce Local Businesses

The GOA-Itasca Chamber of Commerce Local Businesses

Our staff remains operational during this time working to provide short- and long-term business solutions and plans in response to COVID-19.

We encourage you to connect by email with our staff to preserve the continuity of engagement and attainment of your goals.

Please call us at 630.773.2944 or email at [email protected]

Also, we are updating social media with every update we are receiving, please like our page if you haven't done so already to get these updates https://www.facebook.com/GOARegional/

We have also created groups on Facebook dedicated to local businesses at

The GOA Regional Business Association - Shop Local Group

The GOA-Elk Grove Village Chamber of Commerce Local Businesses

The GOA-Itasca Chamber of Commerce Local Businesses

BUSINESS RESOURCES RELATED

TO COVID-19

COVID 19 Restaurant and Janitorial Services

Illinois Governor J.B. Pritzker announced the closing of all bars and restaurants to consumption of food and beverage on premise effective 9pm on Monday, March 16th due to COVID-19.

Please find here a list of cafes and restaurants that offer delivery service and/or have curbside pick-up available. This list is continually being updated with the most current information available, so please check frequently.

We have also put together a list of members and local businesses that specialize in Cleaning and Janitorial. Please click here to view.

Please find here a list of cafes and restaurants that offer delivery service and/or have curbside pick-up available. This list is continually being updated with the most current information available, so please check frequently.

We have also put together a list of members and local businesses that specialize in Cleaning and Janitorial. Please click here to view.

U.S. Small Business Administration (SBA) Updates

News Release – March 19, 2020 – SBA Offers Disaster Assistance to Illinois Small Businesses Economically Impacted by the Coronavirus (COVID-19 )

SPANISH - News Release – March 19, 2020 – SBA Offers Disaster Assistance to Illinois Small Businesses Economically Impacted by the Coronavirus (COVID-19 )

Frequently Asked Questions – Economic Injury Disaster Loans (EIDL)

SBA EIDL Front Line Staff Information

Disaster Business Loan Application

SBA Disaster Assistance in Response to the Coronavirus

SBA Webinar on EIDL

Governor Pritzker Announces Series of New Measures to Help Illinoisans Affected by COVID-19 – March 19, 2020

The State of IL Cornoavirus Response Web Site.

SPANISH - News Release – March 19, 2020 – SBA Offers Disaster Assistance to Illinois Small Businesses Economically Impacted by the Coronavirus (COVID-19 )

Frequently Asked Questions – Economic Injury Disaster Loans (EIDL)

SBA EIDL Front Line Staff Information

Disaster Business Loan Application

SBA Disaster Assistance in Response to the Coronavirus

SBA Webinar on EIDL

Governor Pritzker Announces Series of New Measures to Help Illinoisans Affected by COVID-19 – March 19, 2020

The State of IL Cornoavirus Response Web Site.

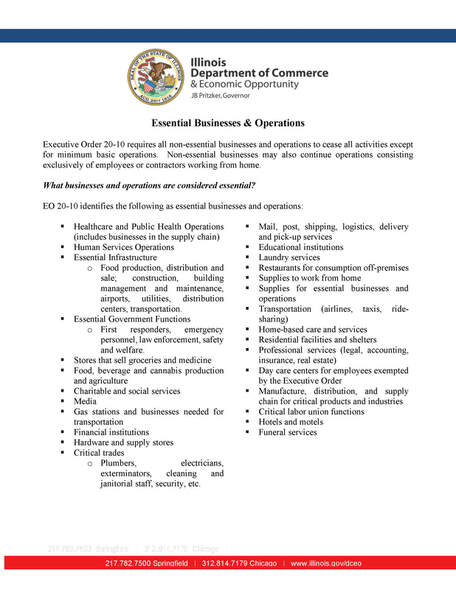

Essential Business Check List from DCEO

Emergency Child Care and Centers

Like schools, most child care programs have been asked to close. But many emergency and essential workers continue to need reliable care for their kids. Thus, the state is in the process of establishing a series of “emergency child care” options – settings that could operate under more flexible-than-usual rules, while still offering kids and families crucial assistance. Existing, interested providers could apply to re-open in this process; other, new providers could explore options for starting-up.

Here’s where to turn for more information on emergency child care homes and centers:

Here’s where to turn for more information on emergency child care homes and centers:

- How to find emergency child care – Call 888-228-1146. In addition, Cook County residents can text 312-736-7390 on weekdays from 8:30 a.m. to 5 p.m. And online, you can find and contact your local Child Care Resource & Referral Agency by clicking here.

- General guidance on establishing emergency-care options, including rules, a license application, list of essential workers, and background-check authorization – click here.

- Related FAQ, including info on the closure of normal child care operations – click here.

|

Click links to be taken to ChooseDupage.com for helpful posts...

|

For more information please go to the CDC website

https://www.cdc.gov/coronavirus/2019-ncov/prepare/prevention.html

https://www.cdc.gov/coronavirus/2019-ncov/prepare/prevention.html